6 minsMay 23, 2018

When you are considering buying a car by availing of a loan, the interest rate is a pivotal factor – you just cannot overlook it.

Besides, with interest being levied on the car loan amount––which depends on the car you wish to buy ––the price of the car, too, holds weightage. Hence getting the best bargain at the showroom or online which involves

deciding the rate with the sales manager/call centre is equally important.

Note that the car dealers have tie-ups for financing with certain lenders, and they often push only those. But as a wise shopper, do find which bank offers you the best interest rate.

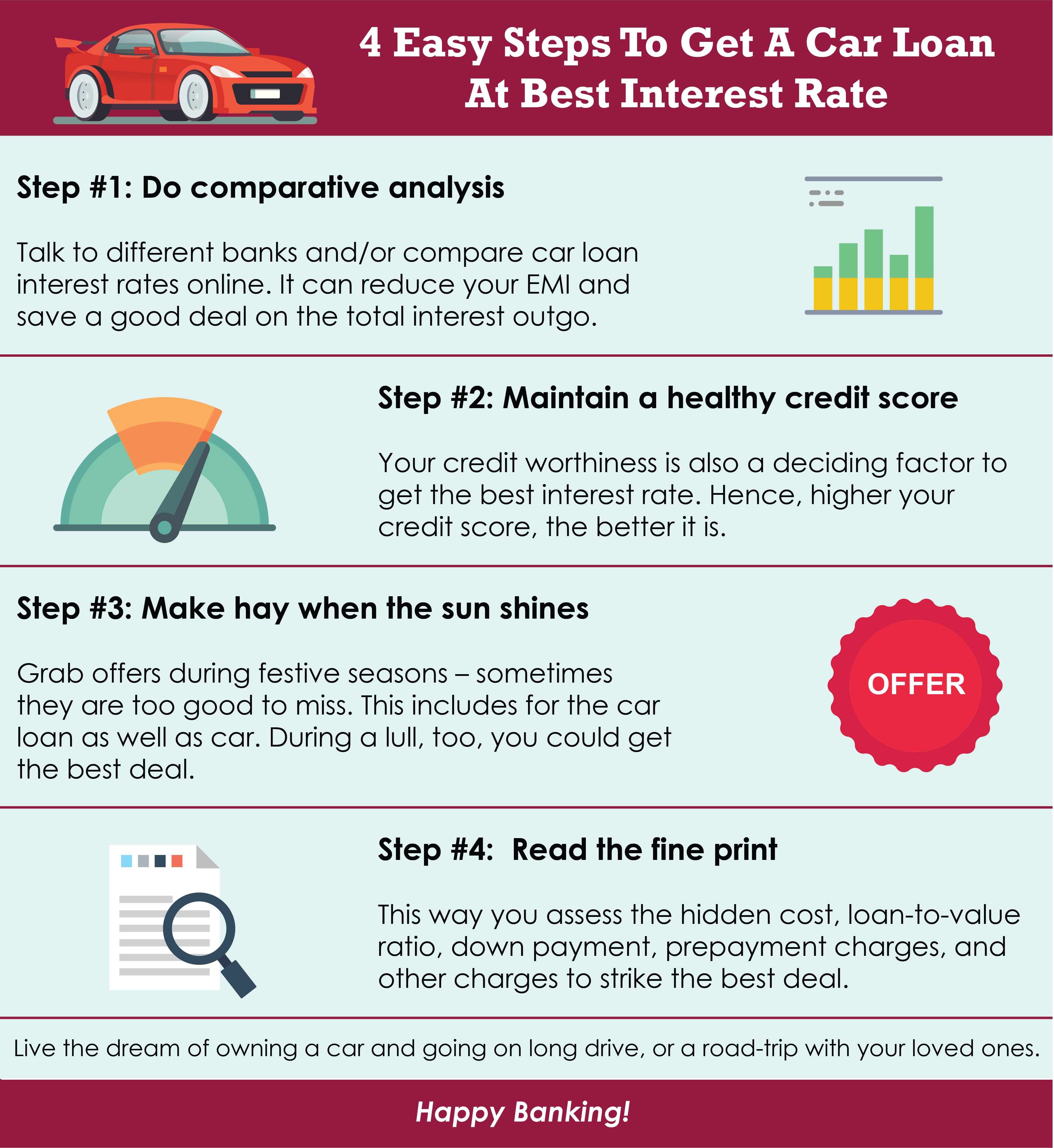

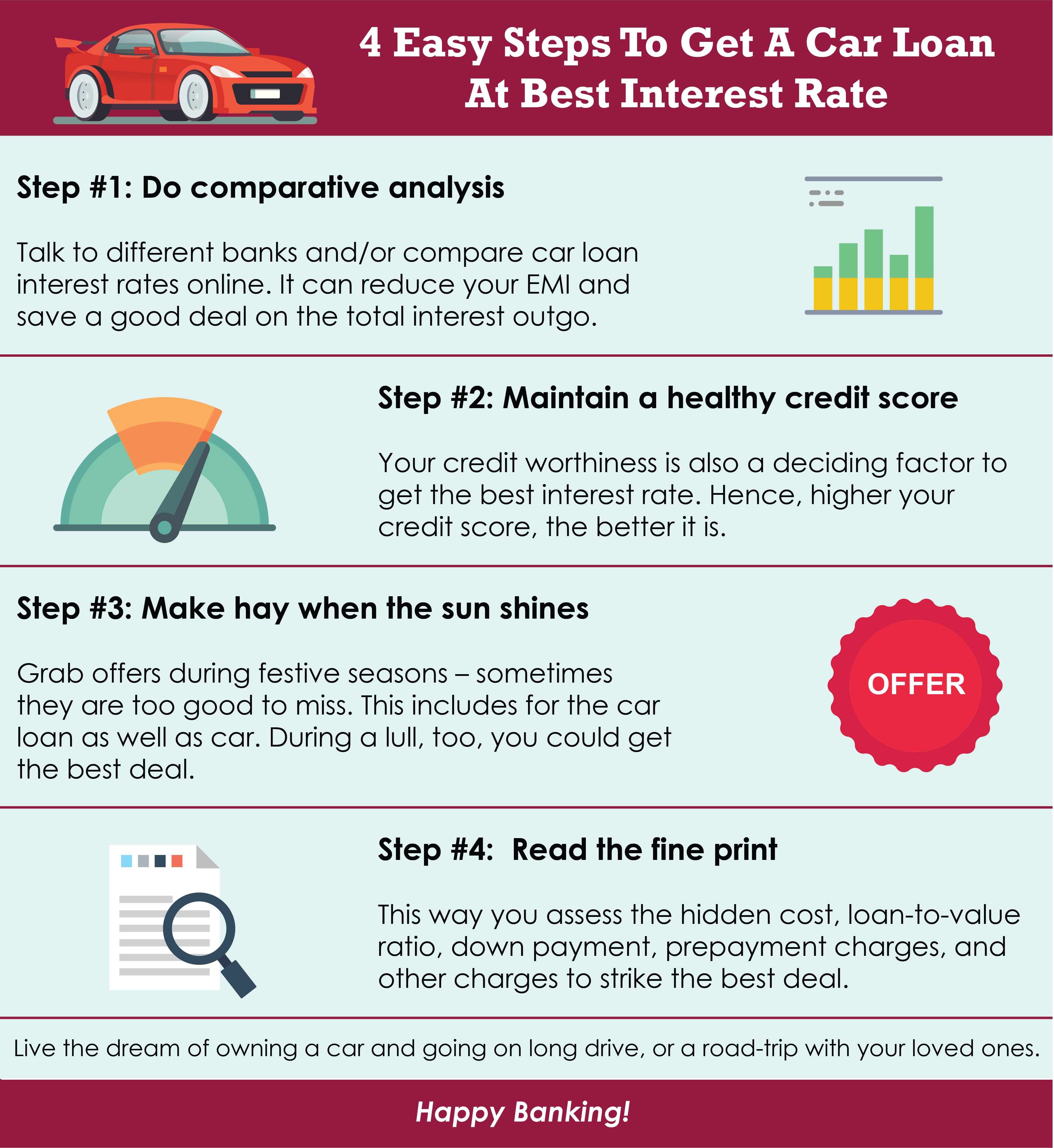

So, here are 4 easy steps to get a car loan at the best interest rate:

- Step #1: Do a comparative analysis

- Talking to different banks and/or comparing car loan rates online will save you a good amount of money on interest outgo over the loan tenure (ranges upto a maximum of 7 years). This saving, will even reduce your car loan EMI and bring down the total cost of the car loan and make sure you strike the best deal!

- Axis Bank offers attractive car loan interest rate to every category of customer – be it salaried individuals, businessmen,

and corporates.

- If you already are a Priority Banking, Burgundy Banking, Wealth Banking orPrivee Banking customer of Axis Bank, it entitles you to special benefits,

viz. lower processing fee, waiver of income documents, bank statements, faster loan processing and much more!

- You also have a chance to earn Axis eDGE Reward points and these can be redeemed against some exciting offers.

- Step #2: Maintain a healthy credit score

- Banks lend at the best rate after they have checked your credit worthiness. Your credit report is sourced by banks from various credit information bureaus to understand your credit score, wherefrom they can judge your credit

behaviour and credit worthiness.

- If your credit score is high (750 and above), the better it is to get the best deal. But if your credit score is low, getting the best interest rate, and/or reducing the loan processing fee could pose a challenge (owing to the high

default risk).

- Therefore, keep your credit score healthy by always making a point to pay your utility bills, credit card bill, and loans/EMI on-time. Also, refrain from opting for too many loans that can impair your credit score.

- [Read here: How To Improve Your Credit Score]

- Step #3: Make hay when the sun shines

- Sometimes certain tangible offers are too good to miss, particularly during festive seasons. Perhaps that’s the time to strike the best deal, because you not only get the best interest rate on car loan, but could also get benefits

such as discount, loyalty bonus, and valuable car accessories from car showrooms. Therefore, be on a lookout for who’s offering you the best deal during such times.

- Step #4: Read the fine print

- Many a times, there’s more than what we perceive. Hence, reading the fine print may help you assess hidden cost, loan-to-value ratio, down payment, prepayment charges, and other charges. And investigative approach can help you

take right decisions.

To conclude…

You see, availing a car loan has certain advantages:

- Instead of everything upfront, which could put you on the radar of the Income-tax department, you just pay a down payment. Banks have schemes with up to 100% funding where the customer does not make any payment.

- Your existing finances are not exhausted

- Existing investments assigned for other important financial goals are left undisturbed

- Self-employed individuals can avail of the depreciation benefit for a loan taken under the name of the organisation

In short, you have opportunity to own the car and drive it happily as you service the loan.

You can apply for car loan with Axis Bank in broadly in three ways:

But applying online is by far the best way, if you are comfortable doing it. The online car loan application can be done from the comfort of your home, office, or wherever you are.

All you got to do is enter your name, e-mail id, mobile number, state, city, captcha code, and accept the disclaimer policy before you clicking on the ‘Submit’ button.

Soon you will receive a call from one of the Axis Bank representatives, explaining the details about your car loan.

Some salaried and self-employed individuals also have a chance to get pre-approved car loans. To check if you are eligible for a pre-approved car loan, SMS CLPA to 5676782 from your registered

mobile number.

To know more about car loan from Axis Bank, click here.

Live the dream of owning a car and going on a long drive or road-trip with your loved ones.

Happy Banking!

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinion on investing. Axis bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.